Hi everyone,

The production bottleneck for Nvidia’s GB200 server cabinets has finally been resolved, and the entire AI supply chain is now sprinting into the second half of the year—sending Nvidia’s market cap briefly soaring past $4 trillion.

Back in March, TechTaiwan reported exclusively that Taiwan Glass’s (台玻) low-CTE fiberglass fabric had become a critical choke point in Nvidia’s AI supply chain. That report has now been confirmed.

Although Taiwan Glass has begun mass production, low yield rates have led to a shortage of high-end substrates. “Demand is moving too fast—it’s far outpacing supply,” one industry insider told me.

With AMD and Broadcom set to ramp up new product orders in Q1 next year, the AI server supply chain is heading toward even greater strain.

As former analyst Jonah Cheng (程正樺) once observed, Jensen Huang’s (黃仁勳) approach is always about “pushing the limits,” relentlessly pursuing the latest and most extreme specs. But in an increasingly complex AI supply chain, a single weak link can bring everything to a halt.

Now, back to this issue of the newsletter:

Last month, a friend in Silicon Valley told me she had unexpectedly met UMC (聯電) engineers heading to Arizona—not TSMC (台積電) engineers building new fabs.

It turns out they were on their way to Intel’s campus in Phoenix, working together to co-develop a new process node.

With both Samsung and Intel falling behind, TSMC is now approaching sub-2nm manufacturing like a lone warrior in the arena.

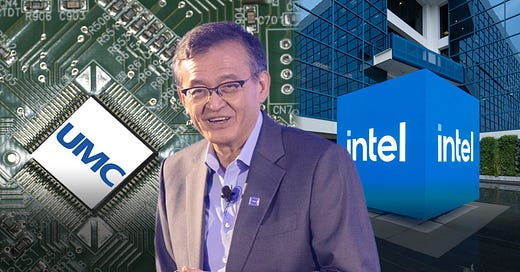

So how is Intel—once a fallen giant—teaming up with UMC, TSMC’s former “twin” in Taiwan’s foundry duopoly, to challenge TSMC once again?

Find out in this issue.

“While most people associate Taiwan’s semiconductor dominance with TSMC, two veteran academics argue that UMC’s story may be even more pivotal.”

That’s the bold thesis put forward by former ITRI (Industrial Technology Research Institute) president and NTHU honorary professor Chin-Tay Shih(史欽泰), along with former CEPD (經建會) minister and NTU economics professor emeritus Tain-Jy Chen(陳添枝).

Their new book, From the Periphery to Innovation: How Taiwan’s Semiconductor Industry Became the Heart of the World (《從邊緣到核心》), offers one of the most in-depth analyses to date on the island’s chip industry. The English edition is expected to be released in the U.S. by the end of the year.

One of the book’s most intriguing arguments is the claim: “No UMC, no TSMC.”

UMC, spun off from ITRI’s Electronics Research and Service Organization in 1980, turned a profit in its very first year by riding the wave of the electronic watch boom. That early success, Shih and Chen argue, gave the government the confidence to back a second, more ambitious semiconductor initiative—the VLSI Project—which directly led to the founding of TSMC.

Semiconductors, by nature, require constant reinvestment in next-generation technologies. While UMC was profitable, it wasn’t generating enough to fund future expansion. Between 1982 and 1987, the company accumulated NT$1.73 billion in profits, far short of what was needed to build a new fab. In 1983, it requested an additional NT$10 billion in capital from its largest shareholder, the government, but the request was denied.

At the time, UMC followed the IDM model, vertically integrating product design, manufacturing, and sales. But as Chen put it, “Because we’re a small country with small companies, we could only focus on niche products like music cards and electronic watch ICs, which didn’t generate much profit.”

That realization prompted a strategic pivot. The government’s NT$10 billion investment ultimately went into a fab that adopted a pure-play foundry model—what would become TSMC. A few years later, UMC also transitioned to a foundry model.

Today, UMC is the world’s fourth-largest contract chipmaker. But it’s once again facing a dilemma not unlike the one it encountered 40 years ago: without continued investment in more advanced nodes, it risks losing its competitive edge.

In 2017, when Jason Wang(王石)and S.C. Chien(簡山傑) took over as co-presidents, UMC announced it would no longer invest in nodes more advanced than 12nm, citing limited customer demand. Since then, its process roadmap has largely plateaued at 28nm.

Avoiding TSMC, Entering the Legacy Node Battlefield

UMC’s strategy was to avoid direct competition with TSMC by pulling resources out of advanced nodes and instead focusing on “making an impact in mature processes,” as Jason Wang stated in media interviews.

For example, UMC became a dominant force in OLED display driver ICs thanks to its early lead in developing 28nm high-voltage processes.

However, the U.S.-China tech war has dramatically upended UMC’s game plan. As China prepares to flood the market with mature-node capacity, the once-safe 28nm-and-below segment is turning into a red ocean.

UMC’s Surprise Alliance with Intel Brings Three Key Advantages

In January 2024, UMC announced a surprise partnership with Intel to develop and manufacture a 12nm process platform—an area where Chinese foundries have struggled to gain traction. The project will be housed in Intel’s Ocotillo campus in Arizona, using Fabs 12, 22, and 32, with foundry services expected to launch in 2027.

For Intel, whose CPUs rely on cutting-edge nodes, these 12nm lines are considered legacy. In the past, such lines were either upgraded or phased out. Now, the UMC partnership offers a way to monetize underutilized assets. “It’s a symbiotic deal,” one foreign equity analyst told me. “Intel needs utilization, UMC needs capacity.”

Over the past year, Taiwanese engineers traveling to Arizona haven’t all come from TSMC. UMC has dispatched some engineers of its own, frequently seen at Intel’s Phoenix-area campuses.

UMC CFO and spokesperson Chi-Tung Liu(劉啟東) confirmed in May that nearly all of the company’s critical R&D efforts are now centered on the 12nm platform, which is currently in the customer onboarding phase.

According to a source familiar with the program, the partnership brings three major advantages.

1. 12nm is the most advanced node that doesn’t require EUV lithography, making it a sweet spot in terms of price-performance. “Many customers stick with 12nm simply because it’s more cost-efficient,” the source said.

2. The node falls under U.S. export controls, making it significantly harder for Chinese foundries like SMIC to obtain the necessary equipment and EDA tools. This allows 12nm to act as a defensive buffer as China scales its mature-node output.

3. While UMC publicly positions the Intel collaboration as a hedge against China, “deep down, it’s about grabbing market share from TSMC,” the source said. “TSMC essentially owns the 12nm space. GlobalFoundries doesn’t offer T-like (TSMC-compatible) processes, so its only 12nm customer is AMD.”

He added, “How much UMC can take from TSMC will be the key indicator of whether this 12nm strategy succeeds.”

The first batch of customer products will be critical. If they succeed, others still on the fence may follow. And if demand grows, Intel has placed no cap on the fab capacity UMC can use.

Why Did Intel Choose UMC?

Why would Intel risk IP leakage by effectively leasing its legacy fabs to a Taiwanese partner?

The answer: Intel wants to learn how to build “T-like”processes, and UMC knows how to do it.

“UMC’s greatest value is that it knows how to do T-like,” a former TSMC executive said.

Put simply, when customers are unwilling to redesign for Intel’s native process, Intel must adapt its technology to match TSMC’s as closely as possible. That’s the only way to win over customers with minimal friction.

An IC design executive explained that to truly achieve T-like compatibility, the process technology, design rules, and PDKs (process design kits) must closely mirror TSMC’s, without infringing on its patents.

A UMC executive elaborated: “We wait for TSMC products to launch, then reverse-engineer their structure and characteristics. Then we work around the patents so that when customers use our T-like process, they can’t tell the difference. There’s a ton of know-how involved.”

“We’re probably the best in the world at doing T-like,” he added.

That capability has sparked industry speculation that Intel might eventually acquire UMC. “There were a lot of rumors about GlobalFoundries making a move, but the real talks were between UMC and Intel,” said one senior industry insider.

When I asked CFO Chi-Tung Liu whether Intel had considered acquiring UMC, he replied flatly, “Not to my knowledge.”

To be fair, Intel’s new CEO, Lip-Bu Tan(陳立武), is still in the early stages of a corporate overhaul amid considerable leadership turnover. In such a turbulent period, the future of the UMC partnership, initiated by former CEO Pat Gelsinger, remains uncertain.

The most pressing question right now is whether Intel still has the will to fully commit to the foundry business.

A former TSMC fab director put it bluntly: If Intel tries to offer 14A for foundry clients, “they might just burn a pile of money for nothing.”

His reasoning: bleeding-edge foundry customers are highly sophisticated, and time-to-market is critical. “One misstep and everything falls apart.” Intel’s already “several generations behind,” why would any customer take that risk?

This may be the moment when Intel needs to swallow its pride and embrace the T-like approach, giving customers a low-risk way to switch. And for UMC, that could mark a rare opening.

But a UMC executive told me they would never publicly say they’re doing “T-like.” “We say we’re working on mainstream process technologies,” he said, “but in reality, mainstream just means T-like.”

Read more here

Exclusive|How Taiwan Glass Became Nvidia’s Unlikely Savior for GB200

TSMC CEO C.C. Wei Turns Taiwan’s TSMC into the World’s TSMC

Is China Catching Up in Semiconductor Talent? And Nvidia’s GPU Delay? Blame It on Heat and Expansion

Exclusive: Episil’s J. H. Shyu on Wolfspeed’s Collapse, Navitas’s Surge, and NVIDIA’s SiC Power Play

UMC partnering with Intel on 12nm is a smart move—no EUV, export-controlled, and highly compatible with TSMC’s processes. It’s quietly creating a second path for foundry customers. Curious if this signals a deeper shift in Intel’s foundry strategy.