Hello everyone,

It’s that time of the year again—time for the annual pilgrimage. Next week marks the COMPUTEX 2025, and AI visionary Jensen Huang(黃仁勳) will once again take the stage to deliver a keynote speech, expected to cause another sensation.

Taiwan’s NVIDIA-powered economic boom is experiencing unprecedented momentum. From January to April this year, the top four listed companies by revenue were all NVIDIA-linked stocks.

Moreover, all four of these companies, each with annual revenues exceeding one trillion, are growing at an astonishing pace: Foxconn(富士康) with a 24.58% year-on-year increase, TSMC with a 43.56% increase, and Quanta(廣達) and Wistron(緯創) even more remarkably at 79.55% and 54.47% respectively.

This deeply resonates with me because, just a few years ago, these four companies were all considered Apple-linked stocks, with their performance closely tied to iPhone and MacBook shipments.

But as Apple’s hardware innovation stagnated and sales slowed, Apple-linked stocks gradually became a thing of the past.

This also reflects a current industry trend: the significant transformation brought by generative AI is still concentrated in the hardware domain, specifically in cloud data centers.

However, more and more people have recently told me that the wind is shifting. The AI wave is finally moving from the “cloud” to the “edge.”

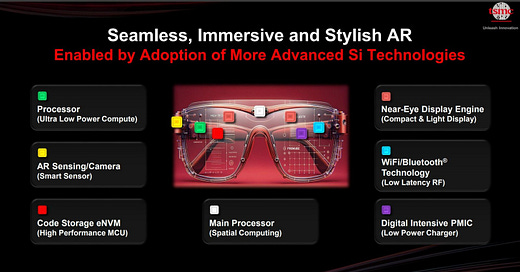

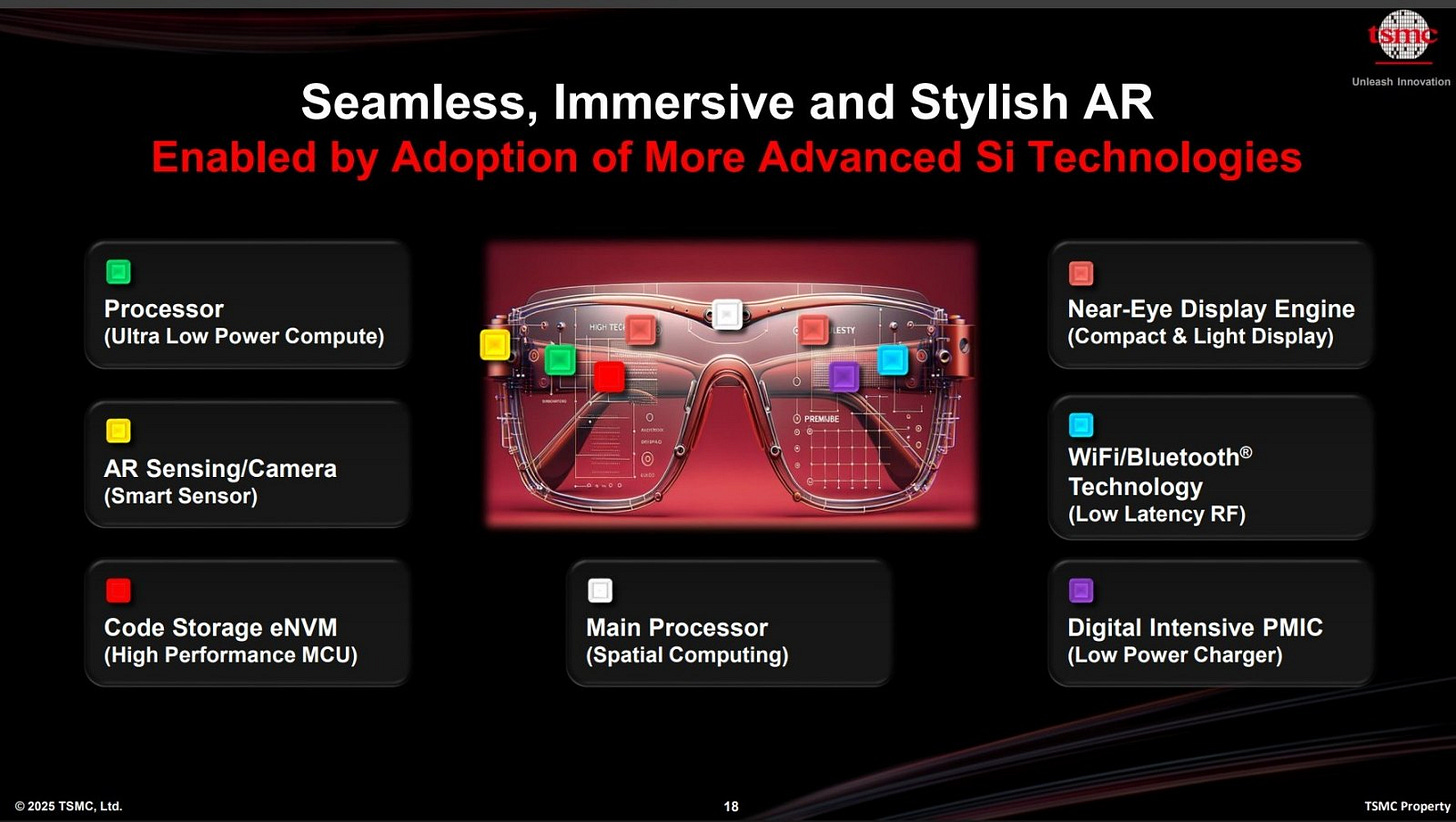

When I saw a keynote at the TSMC Technology Symposium featuring a slide showcasing the technical demands of “AI glasses,” I decided to take a closer look.

Please see this issue of the newsletter.

On last week’s episode of my podcast Tech Taiwan, we welcomed Yu-chao Wang(王昱超), the newly appointed 38-year-old chairman of Radiant Opto-Electronics(瑞儀光電), a key Apple supplier. In a candid and sincere conversation, he shared his thoughts on a tough question: when your company’s core product is on the verge of being replaced by new technology, how do you lead a successful transformation? I wrote about this story in last year's column.

Before recording the episode, I came across a surprising figure. Although Radiant is the world’s largest supplier of LCD backlight modules, and despite the LCD market shrinking as it is gradually replaced by more energy-efficient and higher-performance OLEDs, Radiant’s full-year profit in 2024 hit a record high of NT$7.27 billion.

In the 2025 CommonWealth Taiwan Top 2000 Survey, this ranks 46th in the manufacturing sector, comparable to AI server giant Inventec(英業達).

What explains this?

First, credit goes to Radiant’s founder Ben-ran Wang(王本然)for his correct strategy implemented years ago. The company exited the small-sized (iPhone) and large-sized (TV) markets, which were most susceptible to OLED replacement and had lower technical barriers, to focus on mid-sized markets (tablets and laptops).

More importantly, it has been an industry consensus since 2017 that as iPhones began adopting OLED panels, backlight modules would gradually be phased out.

Therefore, despite Radiant’s strong profitability, there have been no new entrants vying for market share. “No one wants to invest a large sum of money—to build a plant—only to earn profits for just three or four years,” said Yu-chao Wang(王昱超).

In other words, being in a sunset industry has “to some extent, become one of our moats,” he said.

Radiant derives up to 70% of its revenue from Apple, making it arguably the purest Apple-linked stock.

This made me realize just how far the prestige of Apple-linked stocks has fallen.

Curious, I took a look at how the once-leading Apple-linked stocks have fared over time.

Fate #1: Transitioned to NVIDIA-linked stocks

These can be grouped into three categories. The first category includes Taiwan’s three tech giants: TSMC, Foxconn and Quanta. They were respectively Apple’s exclusive chip foundry and main assembly partners for the iPhone and MacBook. As Apple hit a growth plateau, they seamlessly rode the next technological wave, transforming from Apple-linked stocks into AI or NVIDIA stocks.

TSMC’s revenue composition best illustrates this shift. In Q3 2022, smartphones were still its primary revenue source, accounting for 41%.

But after ChatGPT’s debut in Q4 2022, the industry landscape changed dramatically. Just two and a half years later, in Q1 this year, high-performance computing (mainly AI-related products) accounted for 59% of TSMC’s revenue, while smartphones dropped to 28%.

Similar shifts occurred with the other two companies. In a recent earnings call, Foxconn Chairman Young Liu(劉揚偉) projected that AI server revenue would exceed 50% this year, surpassing iPhone for the first time. Quanta expects cloud-related revenue to account for 70%, while laptops will drop to 20%.

Fate #2: Bye-bye Apple, ceded ground to the red supply chain

The second category of companies chose to part ways with Apple under pressure from the advancing Chinese red supply chain.

The most well-known example is Catcher Technology(可成科技), a major aluminum alloy casing manufacturer.

The late Steve Jobs famously pulled the ultra-thin MacBook Air out of a manila envelope in 2008. That was Radiant’s claim to fame. The razor-thin body of the device was made possible by Radiant’s precision manufacturing technology, which integrated the backlight module seamlessly with the aluminum alloy casing.

That casing was made by Catcher.

However, in 2020, Catcher sold its Taizhou(泰州) plant, specializing in iPhone production, to China’s Lens Technology(藍思科技), exiting the iPhone casing business and cutting revenue by 40%.

Wistron and Pegatron(和碩科技) also successively sold their contract manufacturing businesses to another Chinese company, Luxshare ICT(立訊精密), either as a whole plant or by selling a majority stake.

Luxshare and Lens have consequently become Apple’s second- and third-largest contract manufacturers after Foxconn. Chinese Apple suppliers are now rivaling their Taiwanese counterparts in prominence.

Fate #3: Not threatened by Chinese firms, yet missing out on AI

Radiant, along with another key Apple supplier, Largan Precision(大立光電), falls into the third category.

They’re not under threat from the red supply chain, yet they’ve missed out on the AI boom.

Due to product limitations, the current boom of generative AI growth remains concentrated in cloud data centers, leaving these firms watching from the sidelines.

However, when AI applications move to end-user devices, their strengths in producing lightweight, compact, precision components will come into play.

Last year, Radiant acquired a Danish optical firm for NT$10.2 billion to enter the field of metalenses, a disruptive alternative to traditional optics. This technology uses a single, ultra-thin, nanostructured flat lens to replace an entire traditional lens assembly, significantly reducing size and cost.

Yu-Chao Wang(王昱超)expects that “major U.S. clients” will be able to “use our technology to redefine their products.”

For example, “everyone is talking about (smart) glasses,” he believes that the lightweight and energy-saving characteristics of metalenses are perfectly suited for such “wearable” products.

This refers to Meta's second-generation Ray-Ban smart glasses, developed in collaboration with the world’s largest eyewear group, EssilorLuxottica. Priced at $299 per pair, 2 million units have been sold since their launch in September 2023.

The New Battlefield: AI Glasses

“We are now at the inflection point of smart glasses. With the continuous integration of AI features, they have evolved into wearable AI,” said Qualcomm CEO Cristiano Amon during an earnings call in April. Qualcomm is the primary chip supplier for Ray-Ban smart glasses.

In early May, Morgan Stanley released an extensive report, noting that since Google launched the first-generation smart glasses in 2012, the second generation has evolved into “AI glasses,” which are expected to reach annual sales of 30 million units by 2028, becoming a mainstream product.

Former Qualcomm VP of Engineering Chien-Chung Chang(章建中) told me that the industry's previous efforts were aimed at integrating the metaverse into AR glasses, merging the virtual and physical worlds,“but it has always been unattainable.” He was the head of Qualcomm's multimedia division and retired last year.

One challenging issue was the user interface, such as visual guidance and gesture recognition, which were not sufficiently intuitive or user-friendly.

The timely emergence of generative AI solved this problem. Meta’s Llama multimodal large language model enables natural, human-like conversations with AI glasses. “It understands what you say, and you understand what it says,” said Chien-Chung Chang(章建中). Moreover, the 1200-pixel camera integrated into the thick black frame of the glasses allows AI to see and understand what the user is seeing.

So users can ask the AI glasses to identify a dog breed or remember where they parked their car.

Joanna Stern, technology columnist for The Wall Street Journal, recently wrote that she now wears her Ray-Bans all day, asking AI questions about the weather or how to fix a broken garden faucet.

But all this builds on Meta’s foundation as a leader in AI research. Apple’s lag in AI could cause the world’s largest tech company to miss out on the next blockbuster product.

Stern noted that Tim Cook often emphasizes Apple’s strength lies in its “deep integration of hardware, software, and services.” Yet with AI glasses, it’s Meta achieving that integration.

Chien-Chung Chang(章建中) explained that Apple had focused its resources on the Vision Pro AR headset, which does offer the industry’s best performance, but its steep price tag of NT$120,000 confines it to enterprise use.

The key question now is when Apple will finally release a consumer version of smart glasses. “Apple’s entry into the market is crucial. Without Apple glasses, this industry won’t truly take off,” he said.

Another key observation includes Meta and Google’s newly launched Android XR platform, as well as numerous Chinese AI glasses brands. Who will be the first to put a “display” on the glasses?

Power Consumption Is the Bottleneck

Morgan Stanley points out that in September, Meta’s third-generation Ray-Ban glasses will be the first to adopt more affordable LCoS micro-displays instead of expensive Micro OLED or Micro LED.

However, battery life will consequently drop from the current 4–6 hours to less than 2. “So the most important thing in smart glasses design is power consumption,” said Chien-Chung Chang(章建中).

This is also the direction of effort for the entire industry. Last week, Bloomberg reported that Apple is designing a power-efficient processor for glasses based on the Apple Watch chip.

In 2023, Meta announced a partnership with MediaTek(聯發科技) to develop an ASIC (application-specific integrated circuit) for smart glasses. Industry sources say this chip is dedicated to spatial perception, capable of tracking eyes, gestures, and the position of the entire pair of glasses. This is intended to offload computational burden from the main chip and save power.

More importantly, TSMC has also joined in. At this year’s TSMC Technology Symposium, Deputy Co-COO Kevin Zhang(張曉強) concluded his keynote with two final slides, one featuring a robot and the other showing smart glasses. One of the key technological focuses was the “ultra-low power computing” technology.

Read more here:

Radiant Opto-Electronics: On a Mission to Shake Things Up

Apple Advances Chips for Smart Glasses and AI servers

[Exclusive] “China’s Nvidia”: Cambricon and SiCarrier’s Disruption of the Chip Supply Chain

No one wants to wear glasses.