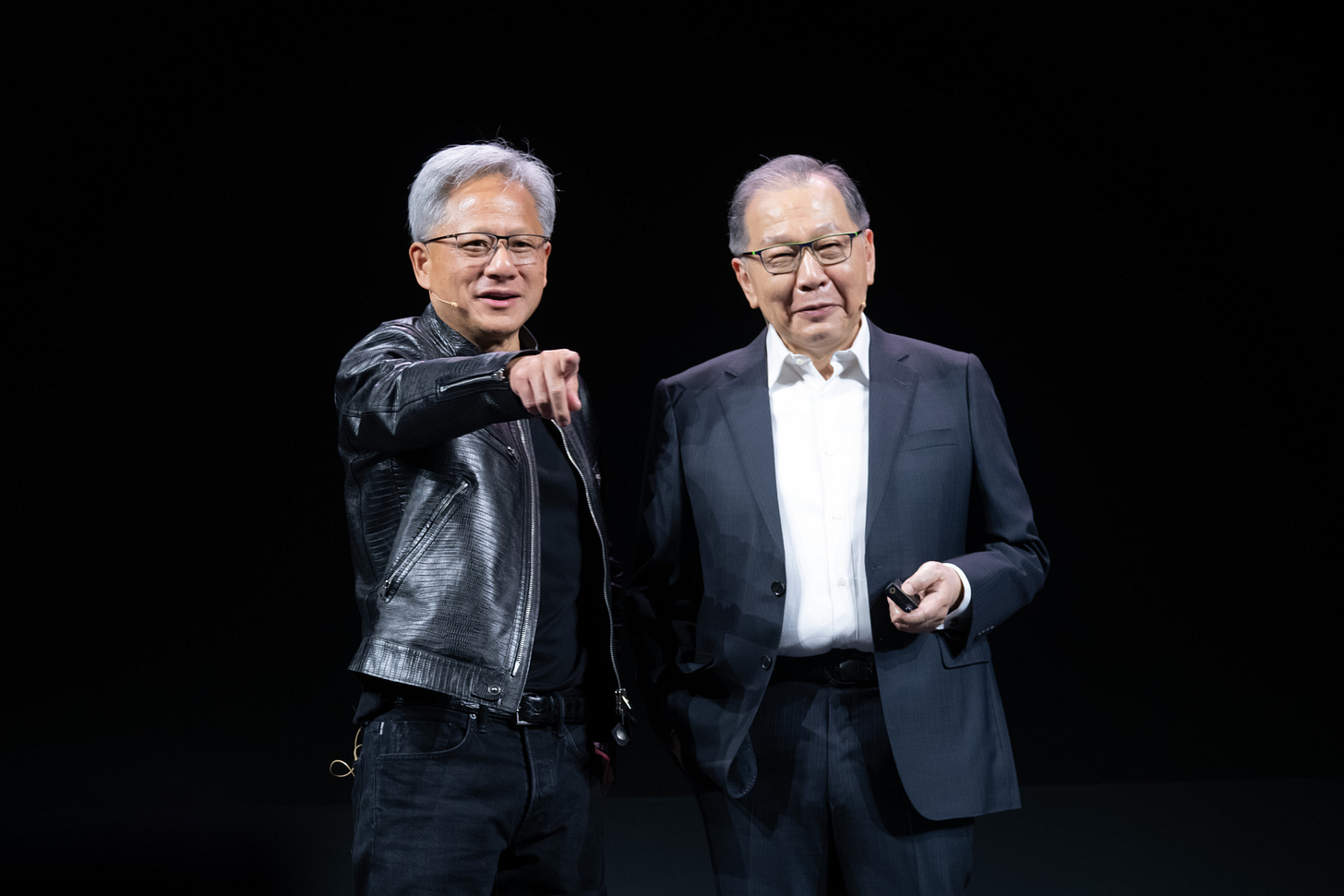

Jensen Huang, founder and CEO of NVIDIA (left) and Rick Tsai, Vice Chairman and CEO of MediaTek (right). Source: Ming-tang Huang

If you're like me, the AI-driven market crash on the eve of Lunar New Year—sparked by the unveiling of DeepSeek R1, a large language model from Hangzhou-based DeepSeek—made for an uneasy holiday. The sudden drop in NVIDIA and AI-related U.S. stocks sent ripples through the industry, leaving many questioning what this disruption really means.

Now that the markets have stabilized somewhat, it's time to analyze the impact of DeepSeek and what it signifies for AI’s future.

Bottom Line: demand for AI computing power remains strong.

Let’s address the biggest concern that’s been gripping Taiwan’s tech industry: DeepSeek claimed to have trained an AI model comparable to those developed by top U.S. AI firms using just $5.5 million and a few hundred second-tier NVIDIA chips. If true, this fundamentally challenges the long-held assumption that "more compute equals better models."

Does this mean the ongoing frenzy for NVIDIA chips will suddenly halt?

Will Taiwan’s booming AI hardware supply chain—expansion across Taiwan’s west coast from TSMC to suppliers—grind to a stop?

Could Taiwan go from being the "arsenal of AI" to a tech “graveyard” of abandoned infrastructure?

The answer is no.

A foreign analyst told me that the consensus in the industry remains unchanged: the AI arms race will only intensify over the next few years.

He attributes the market correction not to DeepSeek but to over-exuberance in AI stocks over the past months. The AI sector had surged too rapidly, and investors, spooked by any sign of disruption, “sold first and asked questions later,” he said.

Anthropic's Amodei Weighs In

Among the many discussions following the market drop, one of the most insightful came from Dario Amodei, co-founder of Anthropic and one of Silicon Valley’s top minds on AI. As the creator of Claude, one of the most advanced AI models today, his take carries weight.

Amodei acknowledges that DeepSeek’s methods are innovative but “not fundamentally different from those employed by leading U.S. AI firms, including Anthropic”. The shockwave it sent through the industry, he argues, comes not from its technical prowess but from the fact that it emerged from China.

More importantly, even if DeepSeek—an AI version PingDuoDuo—has truly devised an ultra-efficient way to train AI models with fewer chips and has open-sourced it, the AI race won’t slow down.

Amodei predicts that any cost savings will be funneled back into even greater investments in AI chips to train even more powerful models. "Because the economic value of training smarter models is simply too massive to ignore," he explains.

By 2026-2027, Amodei foresees U.S. companies pouring tens of billions of dollars into AI, ushering in the era of “million-chip” super data centers.

Race on Data Centers: Optimism for GPUs or ASICs?

His prediction aligns with the latest moves from Microsoft and Meta.

In January, Microsoft announced a record-breaking $80 billion investment in AI data centers for its current fiscal year (ending June 2025). Meanwhile, Meta is set to invest $65 billion in AI infrastructure in 2024, a 70% increase from the previous year.

Most notably, Meta is building a massive new data center in Louisiana—comparable in size to TSMC’s Arizona fab. By the end of the year, it will house 1.3 million GPUs, consuming one gigawatt of electricity, equivalent to a nuclear power plant.

Since the January 27 market crash, TSMC’s stock has lost around 6% as of February 5. In contrast, NVIDIA is still down 12%, raising a crucial industry debate:

Even if AI data centers continue to grow, will NVIDIA still dominate the AI GPU market?

Stacy Rasgon, a leading semiconductor analyst at Bernstein, argues that NVIDIA will remain dominant. He cites the Jevons Paradox—an economic principle from the Industrial Revolution:

When steam engines became more efficient at burning coal, the result wasn’t less coal consumption—instead, demand for steam engines surged, leading to even greater coal use.

By the same logic, with this AI version of PingDuoDuo, more efficient AI models won’t reduce GPU demand—they’ll encourage even more NVIDIA GPU purchases.

A Shift Toward ASICs Will Accelerate

However, a Taiwan-based foreign analyst believes Rasgon is too optimistic. He argues that DeepSeek has already proven that algorithmic optimization can reduce the need for general-purpose GPUs.

Instead of buying NVIDIA GPUs, data centers might shift toward ASICs (application-specific integrated circuits), which are custom-designed for AI workloads.

Big Tech is already moving in this direction: Google, Amazon, and Microsoft are developing their own ASIC chips. They are collaborating with Broadcom and Taiwanese semiconductor firms to design AI chips optimized for specific algorithms. This trend—replacing expensive NVIDIA GPUs with in-house ASIC solutions—could accelerate.

Winners Amid the Chaos: Taiwan’s ASIC Suppliers

While most of Taiwan’s tech sector was rattled by DeepSeek’s emergence, a few companies actually benefited from the disruption.

Alchip Technologies (世芯), a supplier for Amazon’s AI ASICs, and MediaTek (聯發科), rumored to have secured Google’s 7th-generation TPU contract, saw a stock rally. Global Unichip Corp (GUC, 創意電子) and Faraday Technology (智原), both veteran ASIC makers, also saw their share prices soar.

DeepSeek’s Impact on Edge AI: A Breakthrough for Taiwan’s Startups

Jian-Liang Chen, VP of Skymizer, a Taiwanese AI chip startup, also sees DeepSeek’s breakthrough as a game-changer for Edge AI—accelerating its adoption by a full year.

Previously, “people wanted to deploy AI on edge device but didn’t know how. Now, DeepSeek has proven that it’s possible,” he said.

Chen has spent years working on porting AI models from the cloud to local devices. Before DeepSeek, he was betting on Mistral’s NeMo 12B model. But after testing DeepSeek’s “lightweight” 800K sample model, he was blown away.

As part of the team at GUC during its early days, Chen knows when a technology is still evolving rapidly, general-purpose products like GPUs dominate. But once things stabilize, cheaper ASICs take over. Having worked through multiple technology shifts, he believes “we’re nearing another tipping point.”

By 2026: AI ASICs Will Take Off

According to Morgan Stanley, by 2026, the four major cloud players—Google, Microsoft, Meta, and Amazon—will deploy custom-built AI ASICs using 3nm process and advanced CoWoS packaging.

Alchip, MediaTek, and GUC will share AI ASIC contracts with Broadcom and Marvell.

According to Morgan Stanley, AI ASICs currently account for only 4% of TSMC’s revenue but are expected to surge 70% in 2025, reaching $6.7 billion.

The most stunning development is MediaTek’s victory over Broadcom in securing Google’s 7th-gen TPU contract.

One analyst told me, “From what I heard, this single deal alone might be larger than Alchip’s entire annual revenue.” And Alchip’s 2026 revenue forecast is NT$99.6 billion.

This means that MediaTek—a close NVIDIA ally in many ways—will become a formidable competitor. From this perspective, DeepSeek’s rise can be an indirect catalyst for Taiwan’s ASIC ecosystem. Overall, there will be more benefit than harm to technology industries in Taiwan.

And for TSMC, whether GPUs or ASICs win, TSMC still comes out on top. As Morgan Stanley put it: "Regardless of who wins the AI hardware race, TSMC wins.”