Darth Vader in Semiconductor Industry: How the Turncoat and the Loyalist of TSMC Shaped the Global Chip War

Liang-rong Chen

Hello everyone, today is a national holiday, Labor Day on May 1st.

To mark the occasion and take advantage of the day off, I think it would be fitting to revisit one of my classic columns in this issue of the newsletter: “The Turncoat and the Loyalist.”

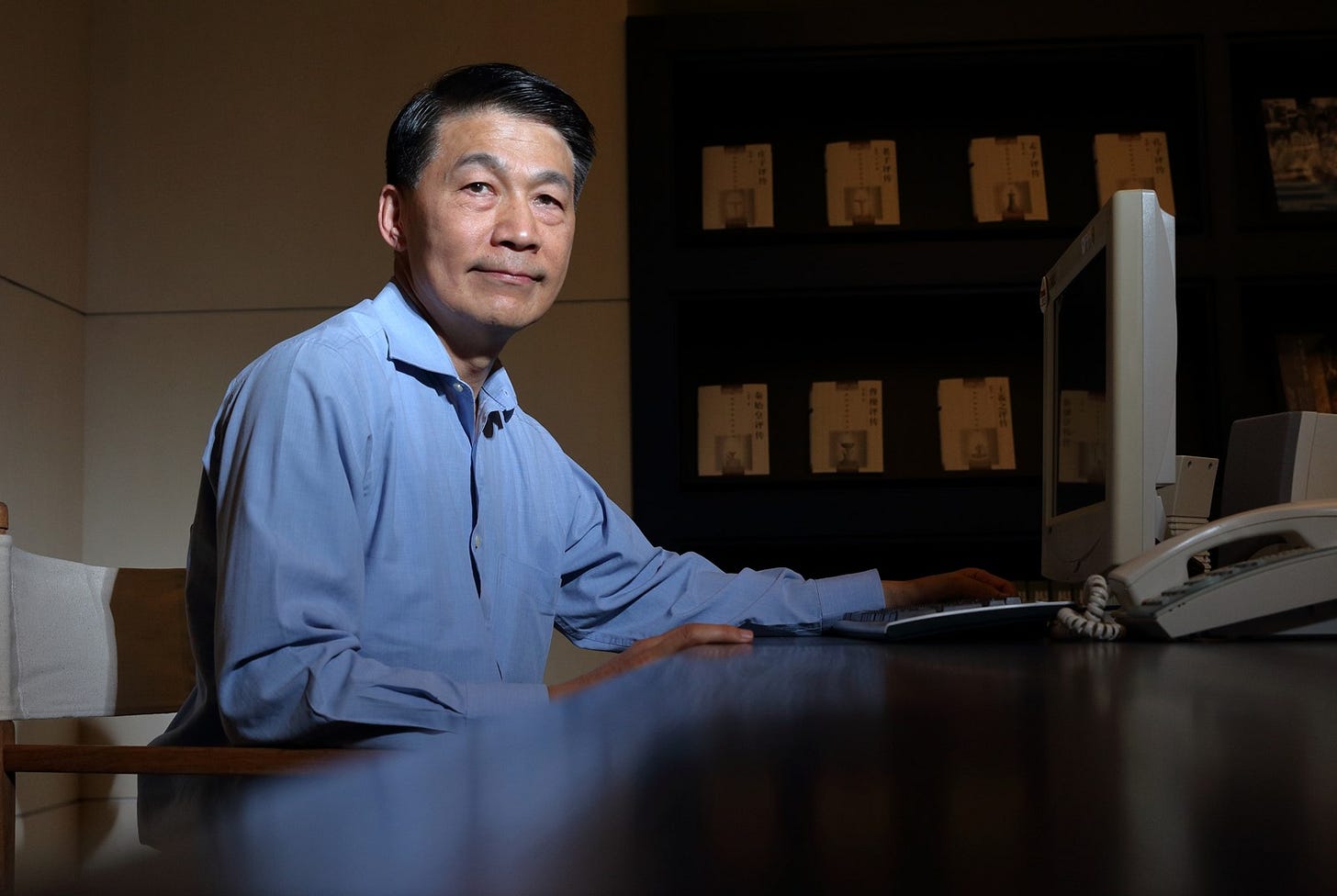

It’s the story of two former heroes in the semiconductor industry: TSMC’s former Vice President of R&D, Douglus Yu(余振華), and SMIC’s co-CEO, Liang Mong-Song(梁孟松). After their respective employers made decisions they disagreed with, the two chose very different paths forward.

This is a workplace dilemma that every employee might face at some point. Since I first reported on Liang Mong-Song ten years ago (in the article “Hunting Down a Turncoat”), his influence in China has only grown.

Most recently, even with a ban on EUV equipment sales, SMIC under his leadership managed to mass-produce 7nm chips and is now advancing toward 5nm, stunning the world. He is increasingly seen as the “Darth Vader of the semiconductor industry.”

Just like the iconic villain in Star Wars, Liang was once a key figure on the side of justice, only to turn to the dark side in anger, eventually facing off against former friends and allies.

But why would such a highly accomplished general be subjected to what seemed like irrational and unfair treatment during his final years at TSMC?

It’s only in recent years that I’ve learned more of the backstory—personnel dynamics far more complex than I ever understood at the time. The truth is enough to make one sigh.

I’ll write a prequel to “Hunting Down a Turncoat” in the future.

For now, please enjoy this issue.

“Moore’s Law is dead. It’s completely over,” Nvidia CEO Jensen Huang(黃仁勳)declared in October 2022, sparking debate within the industry.

In fact, the unique technical demands of generative AI have unquestionably resulted in an unprecedented scenario.

TSMC currently only has one customer, Apple, for its most advanced chipmaking technology, the 3-nanometer process, with speculation emerging that 3nm capacity utilization has fallen as low as 50 percent.

But demand for TSMC’s advanced CoWoS (chip-on-wafer-on-substrate) technology is far outpacing supply, forcing the company to expand capacity.

That led me to ask MediaTek Inc. CEO Rick Tsai(蔡力行)at a public event recently if advanced packaging technology will become more important in the AI era than Moore’s law, which posited that the number of transistors on a chip would double every two years with a minimal rise in cost.

Tsai responded cautiously, saying it was still too early to say [whether packaging technology had overtaken Moore’s law]. But he then acknowledged that “both were important,” a sign that the times have indeed changed.

Packaging technology was once considered the black sheep of the high-tech sector, but in the eyes of this former TSMC CEO who is now one of the chipmaker’s major customers, it is as important as humanity’s most sophisticated chip miniaturization technologies in which hundreds of billions of U.S. dollars have been invested.

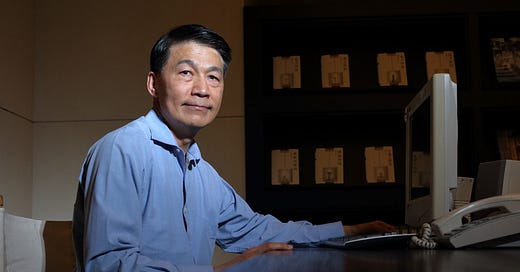

That made me think of one person, TSMC Vice President Douglas Yu(余振華), one of the drivers of this paradigm shift.

Douglas Yu: Keeping TSMC ahead of Samsung

When I interviewed Yu in 2018, he had just developed the InFO (integrated fan-out) packaging technology used for iPhone chips that enabled TSMC to grab Apple orders that were originally going to Samsung.

He was recognized for this important achievement, being promoted to vice president and awarded a Presidential Science Prize on the recommendation of TSMC founder Morris Chang(張忠謀). Chang even attended the award ceremony.

Yu was among the first group of Taiwanese tech standouts working overseas to return to Taiwan in the early 1990s for TSMC.

I asked him why, after researching advanced semiconductor technologies at Bell Laboratories in the United States, was he willing to get involved in the far less prestigious field of packaging technology in Taiwan?

“I had nothing to lose,” he replied.

When he first started at TSMC, he was responsible for developing cutting-edge technologies, but he was later faced with strong competition from at least one very ambitious internal rival eager to stake out his territory. As a result, “I retreated into packaging,” he said.

His main workplace foe was the notorious Liang Mong-song(梁孟松), who would eventually be seen in Taiwan as a traitor by later working for Samsung Electronics and then becoming co-CEO of Chinese chipmaker SMIC.

Liang Mong-song: Key player in U.S.-China tech war

In 2003, Yu and Liang were both honored by the Executive Yuan (Taiwan’s administrative branch of government) as part of the TSMC R&D team that developed 0.13-micron low-k copper system-on-a-chip (SoC) process technology.

For that team, Liang was responsible for the advanced modules, the most important part of the process, while Yu was in charge of integrating TSMC’s copper structures with low-k dielectric materials to make the product work.

It was an important milestone for TSMC in its early years because it enabled copper to replace aluminum as the material for the interconnects that connect elements of chip circuits together, which meant faster chips that used less power.

Any sense of teamwork vanished, however, in 2005, when Chang chose Rick Tsai to succeed him as CEO. There was a major reshuffle of TSMC’s management, and as part of that shake-up, Liang expected to be promoted to the key role of R&D vice president. Instead, he was passed over, leaving him furious.

He eventually jumped to arch-rival Samsung to become chief technology officer for the Korean company’s wafer foundry business, and helped Samsung surge ahead of TSMC on 14nm semiconductor production.

Suspecting Liang of foul play, TSMC sued him for leaking trade secrets.

In a cover story I wrote in early 2015 titled “Hunting Down a Turncoat,” I described him as “Taiwan’s No. 1 turncoat.”

It was still surprising, however, that just two years later, he would leave Korea and go to China, where he had emerged as a key figure in the technology war between Washington and Beijing.

Chinese information and communications giant Huawei shocked the world in 2023 when it apparently got around American sanctions and used an advanced 7nm chip in its newest flagship smartphone. Although Huawei never admitted the chip was made by SMIC, industry insiders strongly suspected that Liang was the “shadow warrior” behind the breakthrough.

Described by the Wall Street Journal in August 2022 as a “Taiwanese chip wizard,” he is believed to have helped SMIC overcome the difficulty of producing advanced chips without the use of high precision EUV (extreme ultraviolet) lithography machines.

“He’s giving his life to his work,” said Yang Guang-lei(楊光磊), the former director of TSMC’s R&D Division and, like Liang, a UC Berkeley alumni.

Yang recalled that after Liang underwent a brain operation a few years ago, he only took two to three weeks to rest before returning to work at SMIC, still driven by his grievances against TSMC.

Demotion or “talent cultivation”?

Why is Liang so obsessed with his former company?

Perhaps it was the irony of fate that in the later stages of Liang’s time at TSMC, he faced adversity similar to that of Douglas Yu.

From managing the most cutting-edge technologies, Liang was reassigned to a new venture called “More than Moore” that would take TSMC’s mature processes and convert them into new products such as automotive chips and image sensors.

Liang saw the transfer as an insult. “Being reassigned to a unit with an extremely small budget and outdated technology was clearly a ‘demotion,’ and could in no uncertain terms be called ‘being given an important responsibility,’” he said at his trade-secrets trial, according to court records.

Some TSMC executives told me that the Liang move reflected Morris Chang’s way of testing and cultivating talent, giving them the opportunity to “squat before leaping.”

Yu took up the challenge by working hard and not complaining, and turned less glamorous advanced packaging technologies into TSMC’s latest competitive advantage.

Yang does not buy that argument. He told me that after Liang returned from an overseas conference, he found his office partitioned into four spaces that he had to share with others. Given Liang’s huge ego, there was no way he could swallow such a rebuke, Yang said.

I most recently saw Yu at the 2023 Semicon Taiwan semiconductor show. By that time, he had been transferred out of the advanced packaging R&D department and made vice president of Pathfinding Technology for System Integration.

The topic of his speech was emerging silicon photonics technology.

“It’s another paradigm shift,” said the executive, now in his late 60s, talking up the new technology with the same passion he had used to promote CoWoS and InFO more than 10 years ago.

One TSMC veteran once told me that Yu has been a model TSMC executive.

“The company has moved him around a lot, but he has never complained and has always done his job to the best of his ability,” the source said.

Two technical geniuses with distinct personalities who faced adversity and setbacks in the workplace responded in dramatically different ways.

Ultimately, they both have affected the global semiconductor industry to varying degrees, with more chapters in their story likely to come.

Read more here:

Riding with Nvidia, Rising to Glory! But Why Do Taiwanese Firms Still Prefer Apple?

The Key Figure Behind TSMC’s U.S. Expansion: TSMC’s Shohei Ohtani, Ying-Lang Wang